Recently, I gave a talk to EM residents about how to take control of their personal finances and before they graduate. I was quite impressed with their questions, their desire to learn more, and their understanding of modern medical practice

The best strategy for killing debt may be simple, but it isn’t easy.

Here’s your choice: Be drowning in debt for a painfully long time or sweep away your student loans quickly using savings. Really, there’s just one choice.

Recently, I gave a talk to EM residents about how to take control of their personal finances and before they graduate. I was quite impressed with their questions, their desire to learn more, and their understanding of modern medical practice.

One of their biggest concerns is what to do about their student loans and other debt. When I was a resident (how many times have you heard that?), the average physician graduated with less than $100,000 in debt. Now, in most cases, it’s more than $200,000, with some physicians incurring more than 300,000 in debt.

Not sure about you, but if I busted my butt for at least seven years between med school and residency, having been paid minimum wage, and then graduating with debt that was more than the price of an average house, I’d be depressed, seriously bummed out. The most common question I got from the residents: “How can I pay off my debt?”

This is a legitimate question, but I’m always baffled when I meet physicians who are still in debt more than five or 10 years after residency.

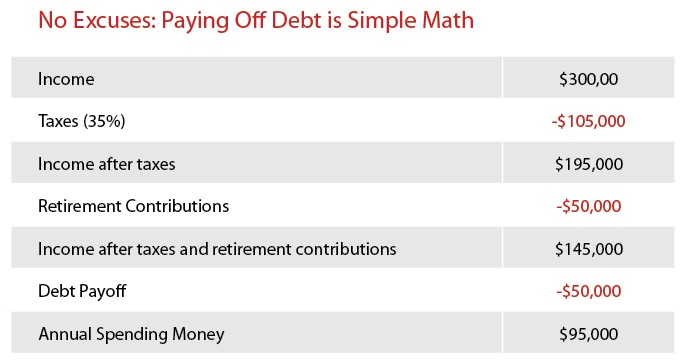

Let’s do some simple math (see chart on next page). Suppose you make $300,000 gross income as an emergency medicine physician. That’s quite reasonable. You pay 35% or $105,000 of that income after adding up all the major taxes on that income: federal income tax, state income tax, Social Security and Medicare. Maybe that’s an overestimate, but this is just a rough calculation. You’re now left with $195,000 to do with whatever you want.

Now you save about $50,000 annually for your retirement. This could be a SEP IRA, an employer sponsored retirement plan along with a taxable account, or other saving options. You now have $145,000 left.

You set aside $50,000 per year toward paying down your debt. Let’s say you’re graduating with $250,000 of debt. Within five years, you’ve paid off your entire debt.

You still have $95,000 left for personal expenses every year. That’s about $8,000 per month — or more than twice what you can spend now as a resident. After five years, you’ve got almost $150,000 to spend annually once you’ve paid off your debt.

Ideally, you take half of the new “winnings” or $25,000 and save even more. You can still spend $120,000 annually.

What does that do for you? Take a look at the chart on page 21 (after the jump) that shows how annual savings of $50,000 a year for the first five years followed by $75,000 of annual savings for the next five years add up, assuming a 7% average annual rate of return. By year 10, you’ve approached millionaire status.

OK, I know what you’re thinking. “But $1 million 10 years from now isn’t worth as much as today.” So what! How many emergency physicians — or any physicians — have a $1 million retirement portfolio by age 40? I suspect it’s a very small number.

While the rest of your colleagues are begging to work MORE shifts, you can’t get rid of shifts fast enough — especially the nights.

“But there’s no way I can do this!” you might object. So you can stay up all night cranking out an ever increasing volume of patients, and treat a patient with an acute MI while at the same time intubate another patient in status epilepticus, but you can’t take 5 minutes to write a check every year to pay down your student loans? Please tell me what I’m missing.

That’s why whenever I hear this question, I counter with “How can you NOT pay down your debt quickly?” I’m not saying it’s easy. I realize you’ve been financially “repressed” for so many years. I was too. You’ve delayed your gratification longer than two presidential election cycles. And you’re itching to spend your newfound money.

But if you lived like a factory worker during your residency years and now you’ve got “sudden wealth,” you can still double your spending and convert yourself from a borrower to an owner in just a few years. No excuses my fellow physician friend. Make it happen!

Setu Mazumdar, MD, CFP® is the president of Physician Wealth Solutions

2 Comments

To the author; with all due respect. You make the numbers seem so simple. I am 12 years post residency and haven’t been able to pay off my debt yet, which was about 125K; combined undergraduate and medical school. Thank goodness for having gone to school before tuition rates became insane. You seem to be forgetting a little thing called interest. Overestimating taxes is always a good thing, but I’m still paycheck to paycheck. Living expenses;food, car payments, auto and home insurance; the basics eat up a sizable amount of that left over money. Then there’s life insurance and disability insurance which is a must unless one want’s to leave the family in dire straits should death or serious injury enter the picture. Then as an independent contractor, Health Insurance costs are high and since the ACA, higher co-pays and out of pocket expenses, with some insurers not even making the plans HSA compliant.So I can’t open an account to defray costs pre-tax. Your accounting I’m afraid is way too simplistic. I have many colleagues in EM who are still living paycheck to paycheck. I/we (the family) are not living lavishly, no frequent or expensive vacations. We live in a modest house with a one car garage in the high property tax area of northern NJ and we bought the home in foreclosure and renouvated. Your assessment of the ease of paying off those loans in that time frame are just not realistic to most of us, unless there’s someone else in the household with decent income and no student loans. Essentially my household is single income.

Regards

Frantz R. Atwell, MD ABEM

Apologies; I didn’t reference the article that I responded to earlier. It was regarding “Knocking Out Debt”. Also I didn’t mention expenses for children etc. Average home has what, 1.6 kids. Can’t even put a yearly price on that. Especially for that .6th of a kid. Going to take a lot of money to make that kid whole; counseling and such.

Regards

Frantz R. Atwell, MD