Most people think emergency medicine is a “safe” career. I disagree. In our specialty we can control some risks (to some extent) such as the number of shifts we work, the group we join, and the hospital we work in. But there are other risks we have no control over, such as the number of patients we see in a shift, frivolous lawsuits and EMTALA.

An essential skill in managing your investments is knowing which risks you can control and which you can’t.

Most people think emergency medicine is a “safe” career. I disagree. In our specialty we can control some risks (to some extent) such as the number of shifts we work, the group we join, and the hospital we work in. But there are other risks we have no control over, such as the number of patients we see in a shift, frivolous lawsuits and EMTALA. Similarly, in finance there are risks you can control and risks you can’t. Let’s take a look at these risks.

Risks You Can Control: Company Specific

Suppose I told you about an incredible investment which had ALL of the following characteristics:

- From 1985, when this investment was first offered, to 1999 it gained almost 25% annually, which was about 40% more ANNUALLY than the US stock market.

- In the tech meltdown of 2000-2002, this investment was UP 44% compared to a LOSS of almost 40% for the US stock market.

- It beat Warren Buffet’s company Berkshire Hathaway by almost 5% per year for a 20-year period ending 2006.

- It has an 85-year history of making money no matter what the market was doing.

- A cover story in Barron’s (a notable investment magazine) in 2004 stated that investors can “sleep well, knowing that even a full-blown financial crisis is unlikely to cripple” this investment.

Now you might be thinking such an investment cannot exist. Surely, if it did, we’d all be taking out second mortgages on our homes to double down on this investment. So what is this golden goose? The investment I’m talking about is the stock of Bear Stearns, which ultimately got wiped out in a single week in 2008. The point of all this is that there are certain risks you can control and which you can eliminate, and at the top of that list is company specific risk, which is the risk of owning stock in individual companies.

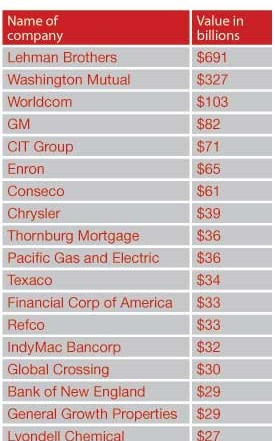

I know what you’re thinking: “But the chances I’ll pick a stock that will go to zero is almost zero.” And that’s where most physicians make a BIG mistake. The keyword is “almost.” While the chance is small, the magnitude of the impact is huge. Take a look at the chart showing the 20 biggest bankruptcies in US history. You’ll see many familiar names in there. Just because a company is big doesn’t mean it’s safe. Even if you own companies that don’t go to zero, company-specific risk still exists because your investment could still significantly lag other investments.

The good news is that you can eliminate company-specific risk almost entirely by diversifying. Even if you’d owned Bear Stearns, if you also had McDonalds, GE, Apple, BP (not zero yet), and many others in your portfolio, having one or a handful of stocks that went to zero would not devastate you. If all of them collapse at the same time, then the world is probably ending and you have more important things to worry about than your investment portfolio.

Risks You Can’t Control

Risks You Can’t Control

There are other financial risks which, unfortunately, you have no control over. No matter what you do, these risks will always be there.

The first and most important one is market risk, which simply means the risk that your portfolio will lose value with a general decline in stock prices. The same is true when investing in bonds. Anytime you dip into the market, whether with individual stocks, bonds, or mutual funds, you are exposed to this risk. Even if you owned every stock in the world, while you have completely eliminated company-specific risk, you can NEVER eliminate market risk. One way you can dampen market risk is to own lots of different broad investments or asset classes, but this only dampens it a little bit. In years where all asset classes take a beating, as in 2008, almost nothing can save you.

The second major type of risk you can’t control is inflation risk, which is the risk of diminishing purchasing power due to rising prices of goods and services. This risk is particularly true for bond investors since generally bonds have fixed interest payments and those interest payments will not keep up with inflation. The best way to dampen this risk is to control what you spend, so if your personal inflation rate is low you are not as sensitive to inflation risk. However, realize that stocks and bonds generally perform poorly in times of high inflation, so even if your personal rate of inflation is low, your investment portfolio can take a big hit with high inflation.

The third category of risks you can’t control is what I like to lump as “all the other risks you can’t control.” Included here is currency risk, which is the risk of investments going down in value due to currency fluctuations. This pertains to international investing when other currencies weaken against the US dollar. Another is event risk, a prime example of which is the recent BP oil disaster. Event risk is particularly bad when combined with company-specific risk, but can happen even if you own lots of companies. For example, the panic in the immediate aftermath of the 9/11 attacks resulted in a big decline in stock prices. There are also lots of other risks you can’t control, such as political risk, liquidity risk and interest rate risk.

What You Need to Do

Total investment risk consists of the risks you can control and the risks you can’t control. As you can see the number of risks you can’t control is far greater than the ones you can control. As an investor you need to focus on the risks you can control, such as company-specific risk, and eliminate these risks altogether. As for risks that you can’t control, the best you can do is accept the appropriate amount of risk to maximize the chance of meeting your financial goals.

Setu Mazumdar, MD practices EM and he is the president of Lotus Wealth Solutions in Atlanta, GA. www.lotuswealthsolutions.com