Forget your return rate. The most important factor in increasing the size of your portfolio is also the simplest: Save more money.

Forget your return rate. The most important factor in increasing the size of your portfolio is also the simplest: Save more money.

In emergency medicine, we often emphasize the wrong metrics to improve patient care. For example, we use patient satisfaction scores as a measure of competence. And ABEM states that completing annual LLSA tests and the new Assessment of Practice Performance (APP) insures that “the highest standards of patient care are established and maintained.” How about we recognize that our residency training in EM, initial board certification, and our subsequent real world experience in the trenches trump annual tests?

It’s the same way in investing. Many people focus on the wrong tactics to build wealth. While the goal of investing is to generate a rate of return that increases the value of your portfolio, it’s actually less important than the one thing that has the greatest impact on the value of your portfolio: the dollar amount of your annual savings.

No matter where you are in your medical career – whether just out of residency or just about to retire – the size of your investment portfolio has more to do with the amount you save than your investment returns.

Early career physicians

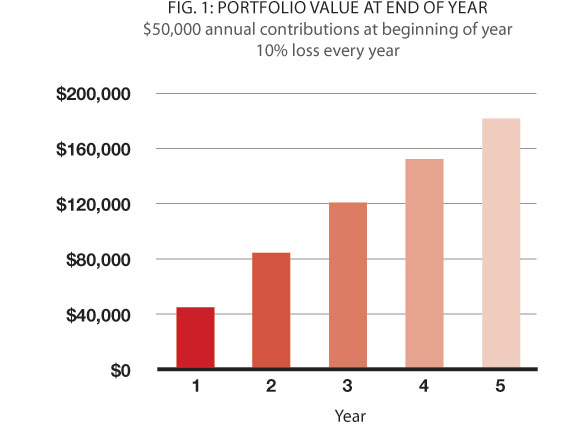

Let’s say you just graduated from residency last year and will make $250,000 in income this year. You join a group as an independent contractor and open a SEP IRA or solo 401(k) and max it out by contributing your first $50,000 on January 1st of this year. Let’s assume you invest it 100% in stocks. Suppose the stock market drops 10% this year for a loss of $5,000 on your $50,000 portfolio. Now you’re left with $45,000 at the end of the year. Then you contribute another $50,000 to your portfolio on January 1st of next year. Now you’ve got a $95,000 portfolio in just two years. While you suffered a loss in your portfolio from a negative investment return, your portfolio value gained 90% from the first year to the next. Suppose every year for 5 years, the same events happen. Figure 1 shows the value of your portfolio over those 5 years.

You can see that despite annual losses, your portfolio value increases every year from your savings.

Now suppose you have gains of 10% annually for 5 years. Even in that case the dollar amount of the portfolio value gain from the investment return is far lower than the dollar amount of the portfolio value gain from your savings, as shown in figure 2.

The percentage gain in the value of your portfolio came mostly from your savings, not from investment returns.

Mid Career Physicians

If you’re in the mid part of your career, the math still makes the savings rate rank high. For example, let’s say you have a $500,000 investment portfolio and you save $50,000 a year. Now let’s say the market drops 10%, leaving you with $450,000. Your next contribution of $50,000 brings the portfolio back up to $500,000. In other words, while your investment return was -10%, your portfolio value didn’t lose anything. Your additional savings effectively cushioned the entire loss. To see what impact your savings have on your portfolio value, take a look at figure 3. The lighter bar shows ending annual portfolio values assuming you start with $500,000, lose -10% annually, and don’t save anything. The bright red bar shows ending portfolio values assuming you contribute $50,000 annually.

Even with a $500,000 portfolio, and assuming a 10% annual gain, your annual savings contribute from one third to one half of the gain in your portfolio value (figure 4).

Late Career Physicians

Your investment returns don’t take over savings until you reach higher portfolio values. Suppose you’re 55 years old, still work full time in EM, have an investment portfolio of $2 million, and you’re saving $50,000 annually. Let’s see what happens when your portfolio loses 10% per year for two consecutive years. Recall that for the early career physician, the portfolio value kept going up due to the higher impact of savings, but for the late career physician, the investment return takes over. While the annual savings cushioned you some from the investment losses, your portfolio still dropped over $300,000 in value over two years despite your annual savings. It’s the same way with gains. Starting with $2 million, after two consecutive 10% annual gains, your portfolio value increases by over $400,000, far outpacing the impact of your annual savings.

A Paradox of Investing

Herein lies a paradox: To get to higher portfolio values, you have to start with lower portfolio values. And at lower portfolio values, it’s the amount you save that counts a lot more. Only at higher portfolio values do investment returns dominate your portfolio’s change in value. So instead of focusing on generating high investment returns, focus on generating a higher savings rate.

Setu Mazumdar, MD practices EM and he is the president of Lotus Wealth Solutions in Atlanta, GA www.lotuswealthsolutions.com