Bundled payments and services could be costing your group’s retirement plan untold thousands. Here’s how to find the added charges, assess the damage, and break the bundle when necessary.

Bundled payments and services could be costing your group’s retirement plan untold thousands. Here’s how to find the added charges, assess the damage, and break the bundle when necessary.

After a busy string of night shifts you’ve been given a breather by working a fast track shift in your hospital’s emergency department. You see a patient that has strep throat so you write him a prescription for antibiotics and some pain medicine, but this is a special type of prescription–he can only get it filled at the store you own across the street. Your store only stocks limited medications by drug companies which pay you for writing their brand name prescriptions instead of lower cost generics. The patient is happy because he likes the convenience of one stop shopping and thinks he received all of this care for free, and your wallet is thicker so you can buy your next plasma TV.

That’s not the way we practice medicine, but in group retirement plans it’s the status quo. Much like the lack of transparency with our tax dollars, most plan participants don’t know where their retirement contribution dollars are going. According to an AARP survey last year, over 70% of 401(k) plan participants think that they are not paying any fees in their 401(k) plan! The most common response I receive when I ask physicians what fees they are paying in their 401(k) plan is “I don’t know.” I can assure you that there is no such thing as a “financial” EMTALA law out there whereby advisors and investment firms are forced to provide services to you for free. But if you get savvy enough, you could save money and increase the size of your retirement portfolio–which is one of the main goals of a group retirement plan.

Bundled vs. Unbundled plans

It’s estimated that about 2/3 of small business retirement plans are bundled plans. In this set up your plan deals with one service provider that handles recordkeeping, administration, custodial services, and investments. In many cases the service provider is an insurance company or a brokerage firm. On the surface this appears to be the ideal setup. It’s a one stop shop and relieves your plan’s trustee of the burden of coordinating these functions with different outside parties.

Contrast that with an unbundled plan. In this type of retirement plan, there are multiple separate and usually unrelated parties that handle various aspects of the plan. There is an independent third party administrator (TPA), an independent investment adviser, an independent custodian, and an independent record keeper (though oftentimes the third party administrator handles this function). As you can see on the surface this setup looks painful, especially for physicians who are the plan’s trustees. If you’ve got an administrative question you call the TPA, but if you’ve got an investment question you call the investment adviser.

While the bundled plan has convenience, remember that convenience has a price–and for group retirement plans that price is usually big.

Revenue Sharing

It has to do with the concept of revenue sharing. Every mutual fund has management fees reflected in its annual expense ratio. For example if you invest $500,000 in a 401(k) which has funds with an average expense ratio of 1% annually, you are paying about $5,000 in mutual fund expenses. In bundled plans part of the money generated from the expense ratio of the fund is used to pay the service provider of the plan. This creates a direct conflict of interest because the bundled service provider to your plan has an incentive to offer your plan only those mutual funds which participate in revenue sharing arrangements. Usually this arrangement results in the annual expense ratios of funds being much higher than other funds which do not participate in revenue sharing.

A host of other problems arise with using funds that participate in revenue sharing arrangements within bundled plans such as:

-

The plan participants think they aren’t paying any fees because they don’t see any line item of fees being deducted in their account statements. In reality the expenses are paid via lower investment returns

-

Since the service provider has an incentive to provide only revenue sharing funds in the list of investment options available to the plan, the total costs may be higher than using an unbundled approach and the choice of investment options may be limited. For example one bundled group retirement plan I looked at stated that the majority of plan assets must be invested in “affiliated funds,” which are funds that pay revenue sharing fees to the service provider

-

Part of the expense ratio in revenue sharing mutual funds goes to the brokerage firm and financial advisor, thus creating another conflict of interest. The financial advisor’s investment recommendations no longer remain objective, he is not acting in a fiduciary capacity, and the plan trustee now has to justify why such an arrangement benefits plan participants

Hidden costs of share classes

Hidden costs of share classes

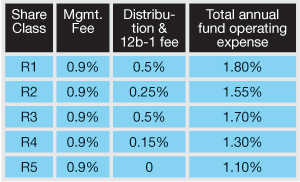

Remember that your plan’s trustee must consider alternatives to current investment options and justify why current investment options were chosen over other alternatives. One way to do this is in a bundled plan is to look at the share class of the funds being offered in your plan. Different share classes of a mutual fund invest in the same pool of securities and have the same investment objectives, but the fees and performance are different for each share class. A common share class used in 401(k) plans is the R share class. Unknown to many plan trustees and plan participants, you may not be provided with the lowest cost R share class in your plan lineup. For example, take a look at the John Hancock Small Company fund. This fund has five share classes for retirement plans, labeled R1 through R5. Suppose your plan provider only offers you the R1 share class which has total operating expenses of 1.8% annually and suppose the aggregate amount of assets across all participants invested in this one fund is $1 million. In that case about $18,000 in annual expenses are being paid to the fund, which then turns around and distributes that expense via revenue sharing arrangements to various parties (advisors, brokerage firms, etc.). What your plan provider may not tell you is that the R5 share class can save your plan thousands of dollars in fees since it charges 1.1% annually or $11,000. So if you’ve got a bundled plan, ask your provider to offer you the lowest cost share class. This automatically results in higher investment performance. Better yet, request your plan provider to offer you institutional share classes, which have even lower fees than the R share classes.

The first step in creating a good group retirement plan is to make sure you have hired fiduciaries who are acting in the plan participants best interests. The second step is to use an unbundled structure so that every fee is disclosed. With the unbundled structure you get greater transparency since you will see a line item of every fee that is being deducted from the plan (investment advisor fee, recordkeeping fee, etc.). It also reduces conflicts of interest since each service provider is independent. Furthermore, if an advisor uses any funds that participate in revenue sharing fees, then those fees should be fully refunded back to the plan, thus reducing total plan costs. The unbundled structure also gives plan participants access to lower cost mutual fu

nds since revenue sharing arrangements are eliminated.

If you’re currently stuck in a bundled plan, read your new 408(b)(2) disclosure to find out how your service providers and advisor are being paid, the dollar amount of expenses you are paying, and what indirect or noncash forms of compensation your advisor is receiving. Then approach your provider and advisor and have them explain what conflicts of interest they have and why they are not offering lower cost fund choices or share classes to your plan.

Setu Mazumdar, MD practices EM and he is the president of Lotus Wealth Solutions in Atlanta, GA www.lotuswealthsolutions.com