Recap from last month: Dr. Smith, a 45 year old emergency physician with a $500,000 investment portfolio, didn’t have time to manage his investments and hired Frank, a financial advisor at a big brokerage firm. To continue the story, upon transferring his portfolio to Frank’s firm, Frank tells Dr. Smith that after thorough research he uses only the best money managers.

Are your financial advisors on your team, or are they playing a game to maximize commissions, fees and kickbacks?

Dr. Smith’s Story Continues…

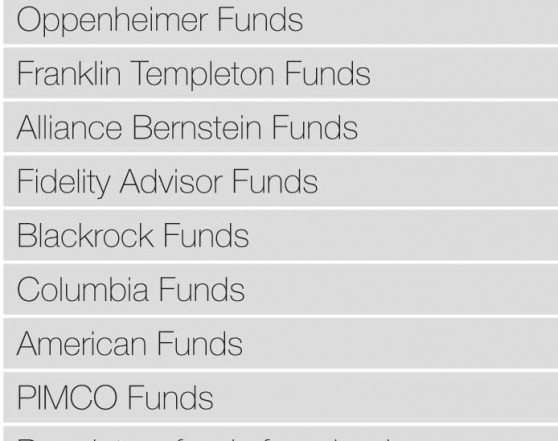

Recap from last month: Dr. Smith, a 45 year old emergency physician with a $500,000 investment portfolio, didn’t have time to manage his investments and hired Frank, a financial advisor at a big brokerage firm. To continue the story, upon transferring his portfolio to Frank’s firm, Frank tells Dr. Smith that after thorough research he uses only the best money managers. Frank initially invests Dr. Smith’s portfolio in 20 different mutual funds, including the following:

- Allianz RCM Technology A

- Alliance Bernstein Wealth Appreciation 4Strategy B

- American Funds New Perspective Class C

Frank tells Dr. Smith that he needs to diversify his investments, so he invests some money in a real estate holding company. Frank also touts the benefits of tax deferral especially since physicians have high income, so Frank puts some of Dr. Smith’s money into variable annuities which defer tax on investment earnings.

One year later, Dr. Smith meets with Frank again to review his portfolio. Frank says that based upon his firm’s research analysts and economic forecasts, he feels it’s necessary to switch most of his mutual funds from his current funds to different funds since it’s likely that the new funds will outperform. These funds include the following:

- PIMCO Total Return Class A

- Fidelity Advisor Overseas Class B

- Pioneer Cullen Value Fund Class C

Dr. Smith feels like Frank is doing a good job by being proactive with his investments and likes the tax strategies he’s using. He’s reassured that Frank and his team of analysts are constantly monitoring money managers and the economic data.

To Be Continued….

Let the Games Begin

Imagine your next acute MI patient. What if you had a choice of two drugs to give the patient: Drug A is more effective but you get paid less if you choose it, and Drug B is less effective but you get paid more if you choose it. What if your income is tied to the drug you give? You might think you’re high and mighty, but let’s face reality: you would at least think about giving the drug that pays you more.

You don’t practice medicine that way, but that’s exactly what the vast majority of financial advisors do with your investments. They’re simply salesman that get paid via kickbacks (commissions) from mutual fund companies and insurance companies. Now think about this for a minute: these advisors aren’t providing you with any actual advice. They’re just selling you stuff for the commission. Yet they mask this under the guise of fancy offices, meaningless titles, and the illusion of effort to make you think that the investments they’ve “discovered” are appropriate for you. Their allegiance is not to you, it’s to the products they sell you and the firm they work for.

Here’s what typically happens. The advisor spreads out your investments among numerous mutual funds, giving you the illusion of diversification and sophistication. Typically these are either Class A, Class B, or Class C share funds, or variable annuities. What that means is that the advisor is getting a kickback for selling EACH fund and for the product vehicle itself (such as the annuity). For A shares that kickback comes when you buy the fund and for Class B or C share funds the kickback comes when you sell the fund years later. But it gets worse. You see, there’s typically a hidden kickback – called a 12b-1 fee – that’s paid every year after the sale to the advisor. So you get hammered on the front end and then slapped on the back end. But what’s downright ugly about all this is that you won’t ever be aware any of this is happening because unlike getting your electricity bill in the mail, you’ll never get a bill for this. Instead, this is taken right off the top of your investment. As an example, if you have a $500,000 portfolio and it’s spread out across 20 Class A share funds, and the commission is 5%, then you’ve automatically lost $25,000 and have only invested $475,000. You’ll never know it but I guarantee you’re paying it.

Think about this: what if there are investments that do NOT pay the advisor a commission but are more appropriate for you and cost less. Do you think that a commission-based advisor will tell you about these investments? That’s about as slim a chance as the government repealing EMTALA.

Just who are these advisors? Try the ones from all of the following: banks, brokerage firms, insurance agents who sell investments via annuities and life insurance, and even so called “independent” and “fee based” advisors from the independent broker-dealers. In other words, almost everyone.

The Game Must Go On

The Game Must Go On

Once an advisor sells you a fund, usually it’s game over – at least as far as advice is concerned. At this point there’s no incentive for the advisor to provide you with anything since he doesn’t get paid unless he sells you something. So the advisor has an incentive to sell you more mutual funds down the road…and the game begins again.

Typically, when you have new money to invest, a commission-based advisor will sell you another fund that’s different than ones you’re already invested in. Or, if you don’t have new money to invest, periodically you’ll get a pitch to switch your current funds to other funds that offer the potential for higher returns. What this usually means is that the advisor is selling you funds for another kickback.

But there’s one more game you need to be aware of. Mutual funds which pay commissions have what are called “breakpoints.” The more you invest in one fund, the lower the commission. Typically this happens every $25,000 to $50,000 in a commission based fund. The problem is that from the advisor’s perspective there’s no reason for him to give you this breakpoint. It’s better for him to spread out your money across many different funds so you pay an overall higher commission. And why not? You’ll never know – you’re too busy with your shifts and you probably don’t pay attention to your investment statements. Honestly, do you even read your statement beyond the first page? Do you even open the envelope?

Conclusion

If you have an advisor you need to know whether you’re part of the game and whose side your advisor is on. Look at your statements, figure out whether you have any commission based products, and find out exactly what you’re paying and why your advisor chose those investments.

Setu Mazumdar, MD, practices EM and is the president of Lotus Wealth Solutions in Atlanta, GA. www.lotuswealthsolutions.com