Unfortunately we have to assume that taxes are going up for everyone–not just “rich” doctors–in 2011. So before you buy all those Christmas presents, you’d be wise to consider some ways to keep more money in your pocket:

It looks very likely that taxes will go up next year. Here are seven tips for softening the blow.

Feel Richer

This sounds kind of strange since most of the time you should defer income to the next year in order to pay less taxes this year. For example, let’s say you have the choice of making an extra $50,000 right now or $50,000 next year and assume for the moment that you’ll be taxed at the highest tax bracket (35%) on the money either now or next year. In that case, purely from a tax perspective, it may be better to make that income next year because you would pay $17,500 less in tax this year by deferring the income.

The problem is that in 2011 income tax rates are going up so it may be better for you to make more money now than one month from now. How do you do that? First, ask your group to give you a higher bonus in December, or if you can pull it off tell them to give you a higher pay rate (hourly or percent or RVU or whatever) for December and than a lower one for January. Or load up on a bunch of shifts right now and reduce your shifts for January. That way you’ll have more income in 2010 and be taxed at a lower rate. Besides, when you pay off your Christmas bills in January, you won’t feel as much pain.

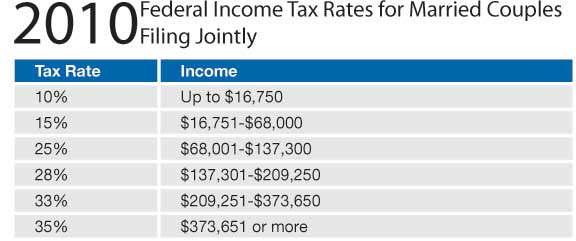

Take a look at the projected tax rates and tax brackets for 2011 compared to 2010. It’s not pretty.

Roth It

Like I said last month, this is the first year you can convert your traditional IRA to a Roth IRA regardless of income. When you do this, you’ll have to report the conversion as income. For example if you convert $10,000 from your traditional IRA to a Roth IRA right now, you have to report that amount as income. That means you’ll pay an extra $3,500 in federal income tax (assuming you are in the highest tax bracket) if you report the income for 2010. For 2010 only, the IRS allows you to report half the income in 2011 and the other half in 2012. But the problem is that income tax rates are going up next year. So for most physicians who are considering a Roth IRA conversion, it’s probably better to do the conversion now and report the income for 2010.

Kiss Dividends Goodbye

Income taxes are going up but so is the tax on dividends. If you own dividend paying stocks in a taxable account, the party is about to end. Right now dividends are taxed at 15% for higher income tax payers, but next month they’ll be taxed at your highest income tax rate – and remember that rate is going up also. So consider selling them now because you can buy them back in a tax deferred account such as your SEP IRA or 401k.

Get Rid of Profits

Let’s say you hit a home run on an individual stock pick (you know this is luck, right?) and you’re thinking about selling. Well, now’s the time to do it. If you’ve got short term gains (stock held less than one year), then you’ll be taxed at your highest rate and as you now know that rate is going up. But even if you’ve held the stock more than one year, capital gains rates are going up also so either way, now’s the time to pull the trigger.

Be More Generous

Maybe you’ve got grown up kids or a nephew. Either way, consider gifting them some cash or stock (perhaps dividend stocks or stocks with big gains). If they’re in a low income tax bracket, they won’t be taxed as much on dividends or interest next year compared to you.

Be a Scrooge

Since income tax rates are going up, your tax deductions are worth more starting next month. So instead of giving more to charity this month, do it next month. Just tell the charity that the three ghosts were a little late and you didn’t come to your senses until January.

Along the same lines see if you can push off a mortgage payment until January (assuming your credit isn’t ruined) so you can deduct the interest next year when it might be worth more. This one is tricky because there are more phase-outs on deductions starting next year.

Pull a Steinbrenner

OK, so it’s not a financial strategy, but it turns out that if you’re going to die, 2010 would be a good year to do it. There’s no estate tax this year, so you could die with $100 million and Uncle Sam won’t get much of it. Just ask George Steinbrenner – he died in 2010 with an estate of several hundred million dollars and didn’t have to pay death taxes. Despite that, the Yankees still lost. In all seriousness, the estate tax comes back full force next month, so make sure you or your advisor address this issue.

Here’s to a less prosperous 2011!

Setu Mazumdar, MD practices EM and is the president of Lotus Wealth Solutions in Atlanta, Georgia. www.lotuswealthsolutions.com