The Six Factors Driving Mergers and Acquisitions in Emergency Medicine in 2018

Merger and Acquisition (M&A) activity in the $20 billion emergency medicine (EM) market is expected to remain strong in 2018 with more transactions on the way this year. The overarching narrative is straightforward: sellers are trying to adapt to new regulatory, technology, and market demands, while buyers and investors are on the hunt for physician groups to strengthen their portfolios.

Consolidation is occurring at an unprecedented pace across the payer-facility-physician continuum. Providers and payors alike view consolidation as a way to improve continuity of care, control costs, and increase profits. In the past 10 years over 500 hospitals have merged into larger health systems and in just the last six years, more than $100 billion has been invested in hospital consolidation.

As a result, today 65% of all hospitals are part of a larger health system network. In 2004, there were 17 national/public payors in operation (remember Coventry?). Today, the number is eight (UnitedHealth, Anthem/BlueCross, Aetna, Cigna, Humana, Centene, Health Net, WellCare) and last year the top five attempted to consolidate into three (the Aetna-Humana merger was blocked on antitrust grounds in 2017). The top three publicly traded payors (UnitedHealthcare, Aetna, Cigna) have a combined enterprise value of over $350 billion, providing scale, significant negotiating leverage, and almost unlimited access to capital.

While there are many different elements contributing to the momentum in healthcare and EM consolidation, six major factors stand out.

The economic rationale remains in place

A significant scale imbalance remains across the healthcare delivery continuum, with the three largest publicly traded payors and hospitals representing $470 billion of enterprise value compared to just $24 billion for the three largest physician staffing services companies (Envision Healthcare, Mednax and Team Health). In healthcare as elsewhere, scale tends to dictate pricing.

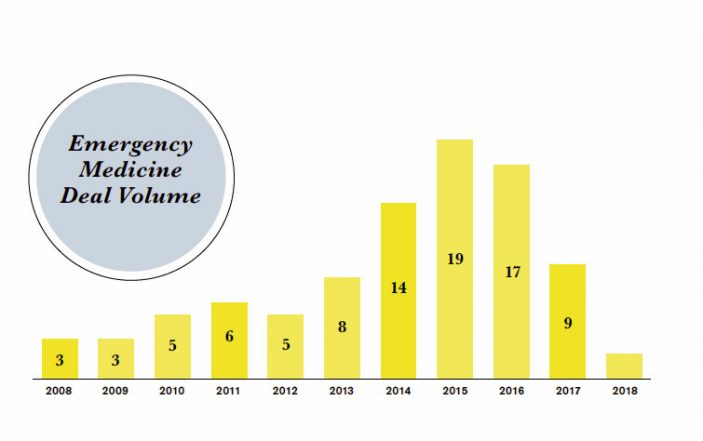

Partly as a reaction to this, consolidation in the emergency medicine market has been gaining speed since the start of 2008 with 90 notable transactions including the EmCare-AMSURG merger ($10bn) as well the acquisitions of larger regional groups such as Emergency Physicians Medical Group (Ann Harbor, MI), Florida Emergency Physicians (Orlando, FL) , Emergency Medicine Consultants (Fort Worth, TX), Emergency Medicine Associates (Germantown, MD) and others. This consolidation volume is outpacing other hospital-based specialties, such as radiology, and is on par with that of anesthesiology.

Currently about 26% of the practicing 35,000 emergency physicians are employed by a handful of consolidators, compared to under 20% only three or four years ago. In other words, more EM physicians are joining large providers, often by selling their practices. Still, 3 out of 4 remain independent or are employed by a hospital or academic center.

Given the trends, many of these independents are likely to be acquired or merge over the next several years. We expect about 40% of all EM physicians to be a part of a major consolidator in the next five years. This will put even more pricing pressure on smaller EM groups as larger consolidators gain economies of scale and negotiating leverage. Regional and local groups represent about 40% of the market, and are the most likely groups to be acquired.

Valuations remain attractive

Though down from their peaks, valuations of EM groups remain attractive, above the 20-year average for healthcare services providers. It is now more compelling than ever for independent EM groups to sell and receive significant cash consideration for their practice’s earnings.

Major Private Equity (PE) Buyer Returns

Private Equity (PE) firms have been major players in healthcare M&A. The past year saw a decline in private equity activity in emergency market for the first time in many years, as one of the major PE-backed acquirers temporarily halted their M&A activity. That group is back as a buyer in 2018 and other PE firms are on the lookout for further acquisitions as well, suggesting renewed activity in the market going forward.

The major PE platforms (US Acute Care Solutions, Alteon Health, American Physician Partners, Integrated Care Physicians) still see a lot of opportunity to bring the benefits of size and scale to EM physicians around the country by enhancing managed care negotiations, consolidating back-office infrastructure, and supporting recruiting in a competitive hiring environment.

M&A is already reshaping how healthcare is delivered

Two major transactions from last year highlight just how fast healthcare is changing. The (announced) $69 billion CVS and Aetna merger and the $4.9 billion acquisition of DaVita Medical Group by Optum/UnitedHealth serve to further blur the line between payors, providers and facilities. If approved by regulators, this kind of cross-discipline consolidation will only add to the mounting pressure for EM physicians to consolidate to larger regional and national practices.

CVS has over 9,700 retail locations and operates over 1,100 MinuteClinics, while Aetna serves an estimated 44.6 million customers, potentially reducing lower acuity ER volumes. Optum, part of the UnitedHealth Group (the largest publicly-traded health insurer in the U.S.), will be adding DaVita’s physician network (which serves 1.7 million patients annually) to its growing provider platform, further increasing pricing pressure on EM physicians, especially for those that are billing patients out of network.

Meanwhile, non-profit hospitals continue to merge as well, with the latest merger announcement between Catholic Health Initiatives and Dignity Health creating the nation’s largest not-for-profit hospital system with combined annual revenue of around $28 billion. Continued hospital consolidation creates increased contract retention risk for independent EM groups.

All this suggests that cost containment and access to patients continues to provide a strategic motivation for transactions, and that smaller EM groups may increasingly find themselves at a competitive disadvantage.

MACRA’s ongoing impact

The Medicare Access and CHIP Reauthorization ACT (MACRA) reimbursement requirements continue to have a growing impact on EM physicians. The number of hospital inpatient quality metrics in 2017 grew to 75, nearly double the 44 required in 2010. Those that fail to keep pace with these new reporting standards risk limiting their entitled reimbursements as well as their ability to target problem areas for improvement.

The Merit-based Incentive Payment System (MIPS) reporting adjustments have created uncertainty and risk in future incomes (tying reimbursement to performance metrics on a national performance scale) while significantly increasing the administrative burden and IT costs for physician groups.

Data from a recent survey of approximately 100 physician groups indicates that groups must be of at least 200 physicians to finance IT investment for MIPS of $500,000 or greater and that only 19% of responders are confident or very confident in their MIPS Reporting. In fact, physician groups that have not met the reporting requirements set forth by MACRA are already experiencing declines in CMS reimbursement; as the reporting requirements increase and are layered with performance metrics, EM physicians will see increasing cost and revenue pressures.

As a practical matter, the continued focus on health outcomes and performance by all constituents of the healthcare continuum (government,hospitals, physicians, patients) makes it likely that different physician and practice groups will see different reimbursement patterns. Bottom line: size matters when it comes to disbursing the cost of MIPS reporting across a larger institution.

Impact of the Tax Cuts and Jobs Act

The recently enacted Tax Cuts and Jobs Act of 2017 creates favorable conditions for a sale of an EM group, particularly for ones practicing in high state and local tax (SALT) states. In a typical transaction, the purchase price is paid at the time of closing and treated as a capital gain for tax purposes (see your tax professional to discuss your individual circumstances). The top federal rate on capital gains is 20%, plus state capital gains rates. The top federal rate on ordinary income is 37%; with state taxes in high SALT states and the marginal rate can top 50%. Converting some of that ordinary income to capital gains can therefore result in a higher effective return from a sale.

Conclusion

In summary, regulatory uncertainty, cost-containment and negotiating leverage pressures continue to support further consolidation in emergency medicine. We expect buyers and sellers to see another active year in 2018.