Imagine that you own a company which makes only one product—sunglasses. On sunny days, you’ll have plenty of customers and sales will soar, but on rainy days you’ll be hurting. Your sales will fluctuate wildly throughout the year. What could you do to make your sales smoother? One option would be to not only sell sunglasses, but to also sell raincoats. The poor sales of sunglasses on rainy days is offset by high sales of raincoats. This would offset the risk of selling sunglasses with the risk of selling raincoats—diversifying away some risk and increasing your profits. Of course on a cloudy day with no sunshine and no rain, you’re out of luck.

With stocks, if you own one stock or a group of stocks in the same industry, it’s like owning just the sunglasses and no raincoats. Take two companies—Walmart and Apple. If you buy either Walmart or Apple alone, your returns depend on events specific to each company. For example, the government may levy a specific tax that hurts Walmart specifically, or Apple may suffer from losing Steve Jobs. By owning both companies you’ve essentially taken away each company’s unique risks, but you’re left with the risk of both Walmart and Apple performing poorly because of a slumping economy (think cloudy day). Financial research shows that only the risk of the asset class gives you a return on your investment because it’s inescapable. For individual investors this is excellent news because you don’t have to worry about buying particular stocks or sectors—you won’t be rewarded any extra for it anyways. Because each industry within an asset class interacts differently with other industries within an asset class, it’s much more important to buy ALL of the components within the asset than any specific component within the asset class in order to take away the unique risks of each component itself.

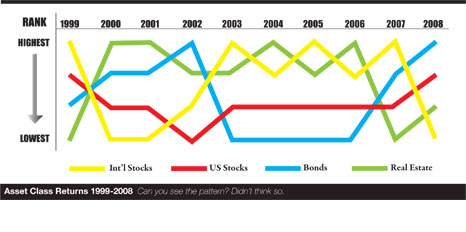

While it’s important to have diversification within an asset class it’s also important to have diversification across asset classes. One of the reasons is that just like individual stocks have variations in returns (think sunglasses vs. raincoats), asset classes also have variations in returns. Take a look at the diagram (above) showing the returns of various asset classes over the past 10 years. You’ll see that there is no pattern: yesterday’s dogs are today’s kings. You’ll also notice that while the US may have the highest contribution to worldwide economic output, international investments can have higher returns for extended periods of time. For this reason having a globally diversified portfolio makes sense. Further, as the year 2008 shows, diversification does not guarantee a positive return every year. It’s most useful feature is that your portfolio’s return will never be equal to the worst performing asset class. In this sense, it provides greater portfolio stability.

Tax Diversification

Looking at diversification even more broadly, taxes also come into play. The concept of tax diversification means that since we don’t know what the tax rates in the future will be, it’s essential to diversify our investments across tax advantaged and taxable accounts. One example of this is the decision to contribute to a Roth IRA or Roth 401k instead of a traditional IRA or 401k. The difference in current versus future tax rates guides this decision. However, it may also be beneficial to place investments in currently taxable accounts, where part of the portfolio is taxed every year in order to take advantage of more favorable capital gains tax rates.

Finally, you should consider your career as an asset class and an investment. As a physician your income will be relatively stable, somewhat analogous to a bond. However, there are inherent risks within our specialty: constant threat of litigation, adverse health effects from night shifts, burnout, needlestick injuries and others. Further, your pay probably won’t keep up with inflation. To offset these career specific risks you could potentially add a second career which has different risks than EM in the hope of offsetting some of these risks. For example, my passion for financial planning and investment management, along with my interest in medicine, led me to the path of launching a wealth management firm for physicians. I know several EPs who work clinical shifts but who are also real estate developers, contract management group directors, and medical informatics software consultants. So if the risks of one career become overwhelming, you’ll have a second income source to fall back on.

Whether you do it yourself or have an advisor, look at your portfolio and ask yourself: Do I have exposure to every industry within an asset class or do I have just a handful of stocks? How many asset classes do I have? How many countries are included in my portfolio? Do I have everything in a retirement plan so I’ll get hit with high taxes when I start withdrawing? Do I have a passion for something that will make me income besides EM? Diversification in the broadest possible sense may be the only “free lunch” you’ll ever get in your investment portfolio. Next month we’ll look at diversification in action, using concrete portfolio examples.

1 Comment

Great. In India, almost everyone missed the sudden downturn. Even the anlysts engaged by large and welknown mutual funds failed to sell off and remain in cash and consequently, Rs.100/ got down to less than Rs.40/. Now they have missed the upturn too !

Iwas well diversified and did better than the funds! Excellent advice. Selecting the right diversification is a problem. Raincoats too may be useless if there is drought !

Rameshmama