You did it! After years of struggling, studying, pinching pennies, watching non-medical friends make cash, buy houses, cars, etc. you’ve finally made it. As a senior resident, you’re now receiving offers that promise to quadruple your meager resident wages.

When you receive a job offer, are you comparing apples to apples and understanding your job’s net present value?

You did it! After years of struggling, studying, pinching pennies, watching non-medical friends make cash, buy houses, cars, etc. you’ve finally made it. As a senior resident, you’re now receiving offers that promise to quadruple your meager resident wages.

But residency probably didn’t teach you about analyzing different job offers. Determining “the best” offer from a financial standpoint is not as easy as it seems, and answering this math question incorrectly could cost you financially down the road.

Let’s visit the concept of discounted cash flow (DCF) analysis and net present value (NPV), and use them to help identify the best of two offers.

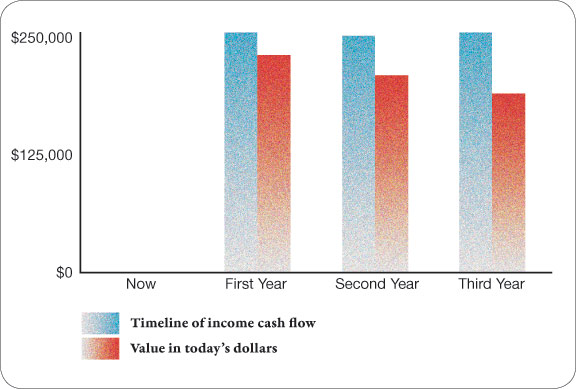

To correctly compare financial offers you need to compare “apples to apples”. To do this, break down the offers into a time series of cash flows. For example suppose starting one year from now, you make $250,000 per year for the next three years. In the table, the blue lines represent this income cash flow. Would you rather have $250,000 one year from now or $250,000 right now? I think you’d agree that $250,000 today is worth more than $250,000 one year from now and three years from now. Another way to look at it is that today’s value of $250,000 one year from now is LESS than $250,000.

So what is $250,000 one year from now worth to you today? To figure this out you have to convert the value of future dollars to the value of today’s dollars. To do this you reduce or “discount” the value of future dollars into today’s dollars. For example suppose between now and one year from now that the price of everything increases 10%. This means that the value of $250,000 one year from now is worth $227,272 today. The value of $250,000 two years from now is worth $206,611 today, and the value of $250,000 three years from now is worth only $187,828 today. The red bars in the graph show the value of future dollars in today’s dollars.

So if you have a job offer that is paying $250,000 annually starting one year from now for the next 3 years, the total value to you in today’s dollars (known as net present value) of that job offer is $621,711. You can now compare various job offers if you have an idea of the future income you’ll get from each offer.

But you can’t just look at the gross income you’ll receive. You also have to take into account the following:

- Magnitude and timing of cash flows

- Non-cash compensation (health insurance, malpractice insurance). Many independent contractor rates do not include health insurance, disability insurance, paid vacation, expense account, etc., while many employee positions will include these benefits. These must be accounted for appropriately in comparing offers.

- Taxes. Here is where things can get complex. I advise you to consult a CPA for all tax related issues as the laws change frequently. Social Security and Medicare taxes eat up 12.4% and 2.9% of your income up to a certain limit. If you’re a salaried employee, you pay only half of this and your employer pays the other half.

However, if you’re an independent contractor, you’ll pay the whole amount. While you can then deduct half of this self-employment tax the net after tax hourly rate for an independent contractor may not look as attractive as being an employee. You also have to consider the state income tax if you’re considering offers from different states.

OK, so let’s start comparing offers. I recommend using the projected income from your job offers to create a projected income statement for the next ten years. Subtract expenses and taxes to determine annual after tax cash flows. Then calculate the present value of the cash flows. A spreadsheet with formulas and sample data is available online here. Using the sample spreadsheet, input your individual figures and the spreadsheet will do the rest. Here is some guidance to get you started.

Determine annual pretax income for the next ten years. If you are a simple independent contractor paid an hourly rate, then multiply your rate times your annual hours and input the numbers for each year.

Include any signing bonuses. Remember, signing bonuses typically will vest over a couple of years and are only taxable after they vest. For example, if you accepted a $50,000 signing bonus that vests over two years (50% after year one and 50% after year two) then on your spreadsheet line item for signing bonus put $25,000 in year one and $25,000 in year two. Create another line item for yearend or RVU bonuses.

Create additional line items for other forms of compensation. This may include health insurance, educational stipend, paid vacation, employer contributions to HSA, etc.

Calculate your total annual compensation (this includes all cash plus benefits).

Calculate taxable income. This should be total cash compensation less non-taxable items like employer HSA contributions, employer retirement contributions, paid healthcare.

Determine your estimated annual tax. Rather than calculate various taxes yourself, consider using an online tax calculator, or work with your accountant to determine tax liability with each offer. Or just assume you’ll pay 30% of your gross income in taxes as a rough estimate.

Subtract estimated annual tax from taxable income to get your net after tax annual cash flows. You should now have ten years of annual cash flows.

Use the Excel NPV (net present value) function to generate a Net Present Value of all your future after-tax cash flows. This provides one number you can use and can effectively compare offers of various structures. For the discount rate in the NPV formula, I use 6%. If you think the cash flows from one job are slightly more risky (i.e. not as likely to happen) when compared to the other job, then use a higher discount rate for the riskier position. As the cash flows from ER medicine are fairly stable, it’s probably best to use the same discount rate across all offers for simplicity sake.

Knowing an NPV for a job offer will allow you to compare apples to apples and choose the most financially rewarding offer with confidence, knowing that you did a thorough analysis.

Before becoming an emergency physician, James Hamilton was a financial analyst at a venture capital firm and Vice President of Medical Technologies at a publicly traded investment firm.

Download excel spreadsheet here.

3 Comments

First off, great article and perfect timing as the new class of senior residents begin thinking about life after residency. I have a few points for the readers to consider.

1. Tracking annual salary takes out the most important denominator in comparing your apples. Time! I make about as much as a friend at Kaiser, but she does 38 hours/wk while I average 30. Huge difference. You should be comparing hourly wages. Site volume/benefits/other factors come into play as well and should all be part of your analysis.

2. Regarding taxation between being an employee vs. independent contractor. The above seems to suggest that you pay more taxes as an independent contractor. Things are more complicated than that…and ultimately independent contractors pay net less taxes. An employee making $300K – relatively high for personal income – will undergo greater scrutiny than the average tax payer. An independing contractor on the other hand will typically incorporate – but a corporation making $300K is relatively small and is not subject to the same level of IRS scrutiny. All else being equal regarding available deductions, the same physician can be far more aggressive with tax avoidance (notice I didn’t say evasion) as an independent contractor than as a high earning employee. An independent contractor who pays a greater net tax rate than their employee counterpart needs a new CPA.

3. Small point, but using inflation as reasoning for the discount of cash flow takes away from the inherent time value of money. If all I am doing is saving for a home, then the last 5 years have been anything but an inflationary market. Money tomorrow is ALWAYS of less value than money today regardless of its purchasing ability. Is the discount rate 7% or 10% or 15% annually? It depends on the person. If you can borrow a 1 year loan for $250K at 4%, then you have found your discount rate. If your credit is horrible and no one would loan you a dime, then it’s far higher.

Any way you can upload a template of the excel spreadsheet? What discount rate should be used?

The link for the excel spreadsheet is now at the bottom of the article.